Fed Cattle Basis

Basis levels are an important tool which indicate the mood of the feeder and fed cattle markets. Cattlemen can use basis levels, as an indication of local supply and demand conditions, to provide market signals to sell cattle early or hold longer. In Canada, two different basis calculations are used, cash-to-cash and cash-to-futures.

On this page:

Cash-to-Cash Basis

| FORMULA: Alberta Fed Steer Spot Price - (Nebraska Fed Steer Spot Price/ spot CAD$) ------------------------- Cash to Cash Basis The Canadian to Nebraska Cash-to-Cash Basis is the difference between the Alberta or Ontario fed cattle cash price and the Nebraska cash price converted to Canadian dollars. |

The cash basis reflects local supply and demand conditions as well as transportation and transaction costs incurred to get cattle from one destination to the other.

The cash basis reflects local supply and demand conditions as well as transportation and transaction costs incurred to get cattle from one destination to the other.

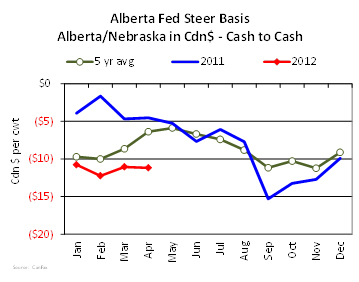

Prior to 2003, the North American market was highly integrated, allowing prices to arbitrage between the two markets. At that time, the AB/NE cash basis averaged $8/cwt ranging between $5 and $10/cwt with the basis being the widest in the summer months and narrowest in the winter months. After the border reopened in 2005, the AB/NE fed cattle cash basis saw significant variation from historical trends. The basis was notably wider, ranging from -$5 to -$20 and had a counter-seasonal trend, with a wider basis seen in the winter months versus in the summer months.

Cash-to-Futures Basis

| FORMULA: Alberta Fed Steer Spot Price - (CME Live Cattle futures/CME Nearby CAD Futures) ------------------------- Cash to Futures Basis The Cash-to-Futures Basis is the difference between the Alberta or Ontario fed cattle cash price and the CME nearby Live Cattle Futures. |

The cash-to-futures basis provides market signals to feedlots on whether they should sell now or wait to sell later. A narrow or positive basis with the current cash price higher than the nearby futures market would indicate that the marketing will be moving lower and producers should sell now. While a wider or negative basis would indicate that the current market price is lower than what it is expected to be in coming months, and therefore waiting to sell would be the best option.

The cash-to-futures basis provides market signals to feedlots on whether they should sell now or wait to sell later. A narrow or positive basis with the current cash price higher than the nearby futures market would indicate that the marketing will be moving lower and producers should sell now. While a wider or negative basis would indicate that the current market price is lower than what it is expected to be in coming months, and therefore waiting to sell would be the best option.

The cash-to-futures basis also has a seasonal trend. Q1 is typically the widest period; Q2 the narrowest.

Many Factors Influence Basis

The Law of One price requires that the Alberta fed cattle price be the price in Nebraska (where prices are set) less the transportation and transactions costs of getting the animal from Alberta to Nebraska. When there is free trade and prices can arbitrage, a wide cash-to-cash basis provides an opportunity for US packers to buy Canadian cattle at a lower cost than domestic cattle. As US packers bid on Canadian cattle, the increased demand for Canadian cattle is reflected in a narrowing of the basis. Therefore, when the basis is wide, fed cattle exports are typically the largest.

However, there are several factors that influence the basis, which can make cross border transactions complicated. Additional costs due to regulation that decrease US packer demand for Canadian cattle, or market factors that make additional volumes unprofitable for US packers, cause the basis to remain wide. These factors include:

- higher transportation and export costs,

- a rapidly fluctuating exchange rate,

- larger cow slaughter decreasing demand for fed cattle, and

- regulations affecting processing costs (e.g. different SRM removal and disposal requirements in Canada and the US, mandatory Country of Origin labelling (mCOOL)).

If US packers are unprofitable, it is not conducive for them to put more cattle through their plants at a loss even if the price of cattle from Canada is lower (e.g. a smaller loss).

In addition to these large market considerations, individual feedlots can have some impact on basis. These include the feedlots’

- distance to the CDN/US border,

- size (number of cattle on feed), and

- average carcass weight on cattle sold,

Why Research Basis?

When regulations are put in place, like U.S. mandatory country of origin labelling (COOL), the extent and duration of the impact different economic and governmental factors have on the cash basis are questioned. In an effort to identify market factors and other drivers influencing the fed cattle basis, a research study1 was initiated to identify and measure the effect various drivers have had on the fed cattle basis.

The study, funded by the AAFC Advancing Canadian Agriculture and Agri-Food (ACAAF) Program, Alberta Beef Producers and Ontario Cattlemen’s Association in 2009, found that both market and regulatory factors had an impact on the fed cattle basis. Major market factors included:

- local supply/demand dynamics

- U.S. cattle prices

- lot size

- carcass weights

- distance from a packer

- transportation costs

- packer/feedlot relationships

- packer utilization levels.

Government regulations were also found to have an impact on the fed basis.

|

The enhanced feed ban, which increased Canadian slaughter costs compared to the U.S., widened the cash basis by CDN$0.79/cwt. In isolating the impact of COOL from other market factors, the research estimates that the impact of COOL on the fed cattle basis in Alberta resulted in the cash to cash basis widening an estimated CDN$2.15/cwt, while in Ontario COOL is estimated to have widened the cash basis by an estimated CDN$3.58/cwt. Note: This study was completed before the amendment in May 2013. It is expected that the cost after the amendment is larger than this study shows. |

|

Feedback

Feedback and questions on the content of this page are welcome. Please e-mail us at info [at] beefresearch [dot] ca.

Acknowledgments

Thanks to Brenna Grant and Andrea Brocklebank of Canfax Research Services for contributing their time and expertise to writing this page.

This topic was last revised on September 8, 2021 at 12:44 PM.

View Web Page

View Web Page View PDF

View PDF